Click on any of the orange headers to see the answers. Click the header again to collapse it.

Insurance and Payments

About Insurance

We accept most insurance plans as partial payment. I participate in most PPO Insurance plans, including Aetna, MetLife, Delta Dental, and Cigna. Once you give us the information, we will contact your insurance company to look up your benefits. Please keep in mind that if you lose your insurance coverage for any reason, you are responsible for the unpaid balance of the insurance benefit.

Flexible Benefits

We will be happy to work with you regarding your flexible benefits. Just tell us that you have a flex plan and we will help you with this.

Payments

We provide several payment and financing options. Once Dr. Silverstein determines your treatment plan, we can provide you with a financial worksheet with the payment options.

Can you give me some examples of how my orthodontic benefit works?

Orthodontic Insurance does not work the same way as your dental insurance does. People who are familiar with how their dental insurance works have a difficult time understanding why this is, or they call their insurance company or their HR rep to find out what their benefit is, and because they don't know the correct questions to ask, receive either incomplete information about their plan, or get an answer that is not correct. Some people try to do their homework before seeing us and are so sure that they understand their coverage before they come in that they will not listen to our explanations. This creates misunderstandings and certainly does not contribute to the kind of positive relationship that we want to have with you. Please read the information below before you come in for your first visit. This will save you a lot of frustration, and give you the time to do the research yourself once you know what questions to ask your insurance company. This information is not specific to my office; it's how all plans operate (at least in NJ).

Q: My benefit is $1500 per year, just like my dental plan, right?

A: Probably not. This is a perfect example of how orthodontic coverage differs from dental coverage. The orthodontic benefit is a LIFETIME maximum; you do not get this amount each year. To be sure, look at your plan documents or ask the insurance company if your orthodontic (NOT dental) benefit is per year, or lifetime. Out of thousands of claims, I have only seen a yearly ortho benefit once.

Q: I have $3000 in orthodontic benefit, so that's how much the insurance company will be paying you, right?

A: Probably not. The overwhelming majority of plans pay a percentage of the orthodontic fee UP TO the lifetime benefit that you have. Most plans pay 50% of the maximum allowable charge up to whatever your lifetime maximum is. The 50% is the limit, not the dollar amount. So for example, if the orthodontic fee is $6000 or more, since your benefit is 50% of that, you will get your entire benefit. If the fee is $4000, you would only get $2000, even though you are paying a premium for a $3000 benefit. I know, this is deceptive. And it has nothing to do with me. In fact, if you are going to an orthodontist who participates in your insurance plan, the insurance company dictates a maximum allowable charge that the orthodontist can charge you, that is frequently less than double your max. So they know that they are advertising a benefit to you that you will never get. Don't shoot me, I'm just the messenger. It's not that we are filling out the paperwork wrong; it's that your insurance company has deceived you.

In addition, every plan has fine print, and this is information that I can't find out ahead of time (before treatment is started), because insurance companies do not provide this type of information to us as providers. Despite us using the methods that insurance companies provide us with (web site, phone calls) to get this information, sometimes we don't find out that you will not be getting your full benefit until after treatment starts and we see how much they are paying us per month. These types of details are in the contract that your employer has with the insurance company, and unfortunately, we can't do anything pro-actively about this (pre-determinations do not contain this kind of information). In fact, this is the type of thing stated on the insurance company's web site when we try to check benefits: "This is not a guarantee of benefits. All benefits are governed by the group contract and are subject to eligibility, maximums, deductibles, limitations, exclusions, waiting periods, and/or frequency limitations contained therein." They don't provide us with any way to get this information.

Q: I want to use my $1500 benefit as the down payment, since they pay you this up front. Is this correct?

A: The insurance company NEVER pays out their orthodontic benefit in one lump sum (unlike for your dental plan, where this can and does happen). They pay monthly or quarterly, and require us to re-submit forms to them attesting to the fact that you are still in treatment. And they spread out the payments as long as they can. Why? So if you lose your job they can stop paying the benefit. It saves them money. Which also means that if you do lose your job while you (or your child) is in treatment, you will lose your benefit and you are then responsible to us for the balance that the insurance company did not pay. Ask your insurance company how often they pay their providers (they may or may not tell you) and what happens if you lose your job while in orthodontic treatment. (You have to ask specifically about the ortho benefit, and not the dental benefit, and make sure the person on the other end of the phone understands what you are asking).

Q: I have a $1500 benefit, and my husband's plan has a $2000 benefit. My HR rep/insurance agent told me that both plans will pay. Won't they?

A: Maybe, and maybe not. There are a couple of issues here. The first is that most insurance companies do something called "Coordination of Benefits." It sounds very nice, doesn't it? The insurance companies are working together for my benefit... It's the opposite. They found a way to NOT pay your benefit that you thought you had. Here's how it works: The plan with the $1500 benefit is the primary plan (see below), and the one with the $2000 benefit is the secondary plan. All situations with more than one insurance coverage require that we submit to the primary insurance company first, then when we get the explanation of benefits (EOB) from them, we have to submit that, along with another insurance form to the secondary company. In this example, we submit to the first insurance company, and they send back an EOB that says that you are to receive $1500 (as long as you keep your job for the entire length of time that they will be paying the benefit out). We submit that to the secondary company, who says, "Oh, you are getting $1500 from the first insurance company. Well, your benefit with us is a total of $2000 and since you are already getting $1500 from the other company, we only have to pay $500." The "coordination" is seeing if the other company paid anything to you so that they can deduct that amount from what they are supposed to pay. When you have more than one plan, you need to ask both companies if they "coordinate" benefits. On the bright side, some companies pay the entire benefit that they say you have in addition to what the other company pays. You can know this ahead of time if you call both companies and ask how they do this. But you have to specifically tell them that you have two insurance plans, confirm whose is primary, and ask them if they coordinate the benefits with the other insurance company or not. We can then help you figure out what your net benefit is going to be based on which company is primary and which is secondary.

Q: I have 2 plans. How do I know which is primary?

A: For patients under 18, the "birthday rule" usually applies, meaning the parent whose birthday comes first in a calendar year has the primary plan (it's not which parent is older, it's whose birthday comes first during the year). If the patient is over 18, the patient's policy is primary, and their spouse's policy is secondary.

Q: My plan says that children over 18 are covered. Is this the case?

A: Maybe. Some have fine print that says they must be in college, or have other stipulations. You need to ask your insurance company or HR department about this on a case by case basis.

Q: I want to send in a "pre-determination" to be absolutely sure of what the insurance company will cover before I start treatment. Can you do this?

A: Yes, but... Every single pre-determination form that I have ever seen has a disclaimer that this is not a guarantee of payment. Why? I don't know. What's the point of doing this besides wasting your time and my time if it is not? The insurance companies will tell you that if you want to be sure of what your coverage is, you should have your orthodontist submit a pre-determination prior to starting treatment. Since it's not a guarantee, the only reason that they are doing this is to delay payment, and your treatment. The only way to know for sure is to submit for actual treatment, which can only be done AFTER you actually start. If you think by submitting a pre-determination that you will then have something definitive that you can use to fight with the insurance company over if they decide to pay less (like they didn't tell you about the coordination of benefits until after the actual treatment is started), you are mistaken. They will just tell you to read the form where it tells you that the pre-determination is not a guarantee of payment. Even what they tell you/us over the phone can change after we submit the paperwork for actual treatment. I've seen what they pay both go up and down. Consider that what they tell you over the phone or in a pre-determination is what the general guidelines are for your plan; it's what you should be getting, probably. Once the actual adjuster who is authorizing the payment gets a hold of the "in treatment" submission, they are going to do whatever it is that they do, and there is no way to be 100% certain what this is beforehand.

Q: But my dentist's office looked it up on the computer for me, and they told me...

A: It's not their fault. They are just not familiar enough with how the orthodontic coverage works. They are used to dealing with the dental insurance, and they don't know the differences or don't know what questions to ask to give you a complete picture. Remember, the person providing your treatment (the orthodontist) is last on the totem pole of priority for your insurance company. Their primary interest is their shareholders. Next come the group administrators. You, the patient are next, and the provider is LAST. I don’t work for your insurance company, and often they will refuse to give me information on how they calculate their fees, citing this as proprietary information. The put me in the middle to look like I am the one to blame because I am the one that they care about the least. They put deceptive practices in place (like lie to you about your benefit), and blame me, the provider when things are not as you have been lead to believe. Patients will often call the insurance company up to ask what their benefit is, and the rep routinely tells them only the maximum without revealing all of the other things that reduce that benefit (like the fact that they only pay a percentage up to that maximum and coordination of benefits may reduce or even eliminate your benefit). You, then call my office and expect to hear the same thing. When I tell you the truth, it looks like I am the bad guy and your insurance plan is the good guy. I’m not the bad guy; I’m just the one who has the integrity to tell you the whole truth. Not withstanding any of the above, we will do everything we can to help you to get the entire benefit that you are entitled to.

I am divorced. Can you set up 2 payment accounts: one for me and one for my ex?

Based upon prior experience, we can only accept a payment plan from one party. In divorce situations, either the custodial parent will need to sign a contract with us for the entire amount (other than expected insurance coverage) and they can pursue the non-custodial parent for their portion, or we will need payment in full of the non-custodial parent's portion from them before treatment starts.

Growth and Development

Thumb or Finger Sucking

Thumb and other finger sucking habits usually have the effect of pushing out on the upper teeth and pushing back on the lower teeth. As the upper teeth move forward, spaces develop. As the lower teeth move inward, crowding occurs. These people also usually have "anterior open bites." This means that when the person closes his or her mouth all the way, the front teeth don't meet since the thumb or finger has prevented them from erupting. Depending on the aggressiveness of the habit, we usually see a width mismatch between the upper and lower arches. Typically, if the child is aggressively sucking her thumb, this constricts the cheeks which in turn constricts the upper arch form. Normally, the upper back teeth are supposed to be wider than the lower back teeth. With aggressive thumb suckers, the upper back teeth can be inside the lower back teeth (when the upper teeth are inside the lower teeth this is called a "crossbite").

An excellent book on this subject, HELPING THE THUMB-SUCKING CHILD, was written by Rosemarie A. Van Norman, a Certified Oral Myologist. You can order the book on Amazon.com.

Parents may also wish to consider other aids:

What is "leeway" or "E" space?

Leeway space is the size differential between the primary posterior teeth (canine, first and second molars labeled C, D and E in the picture), and the permanent canine and first and second premolar (labeled 3, 4 and 5). Usually the sum of the primary tooth widths is greater than that of their permanent successors. So when these primary teeth fall out, there is usually a slight amount of space (about 2.5mm per side in the lower arch and 1.5mm per side in the upper arch). We can use this to our advantage to gain space to help relieve crowding. If nothing is done to preserve this space, the permanent first molars almost always drift forward to close it.

"E" space can be thought of as a subset of the leeway space. This refers only to the size differential between the E's and the 5's as per the picture above. The distinction is made between Leeway Space and "E" Space since in the typical eruption pattern, the lower E's are the last primary teeth to be lost in the lower arch, and frequently the 3's and 4's are fully erupted. If the orthodontist sees the patient after the 3's and 4's are already erupted, the only size differential that needs to be taken into consideration is that between the E's and 5's.

Appliances

What kinds of braces do you offer?

We offer the following metal (stainless steel) and clear ceramic braces (for an extra charge):

Retainer Types

Retainers can either be removable, or fixed (they are not meant to come out).

Removables

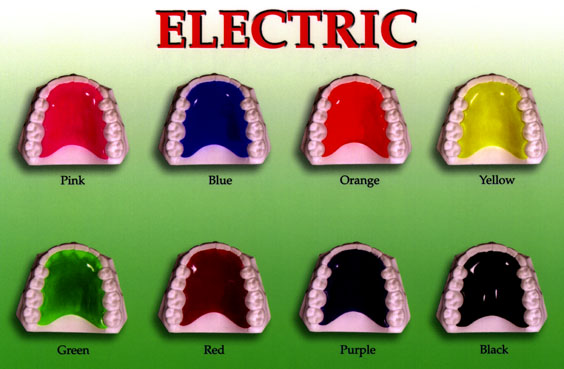

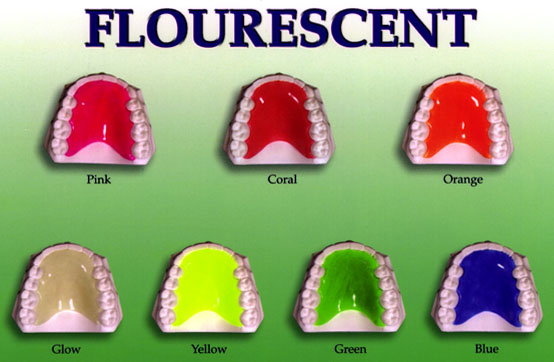

The Hawley type retainer can more efficiently move teeth if any of them need to be shifted.

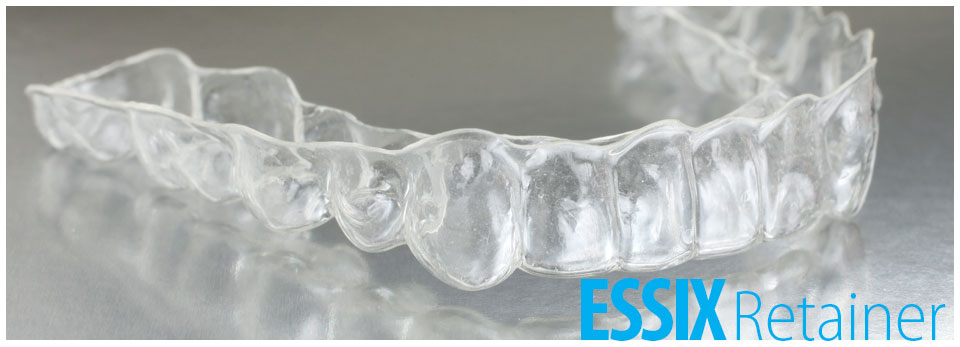

The Essix retainer is easier to talk with, and better able to hold the vertical levels of the teeth if necessary.

The Hawley retainers typically last for many years.

The Essix retainer can crack and wear out, depending on how careful you are with it and how much you grind or clench your teeth. They typically don't last more than a year.

I don't use Vivera retainers because Invisalign trims them short of the most retentive part of the tooth.

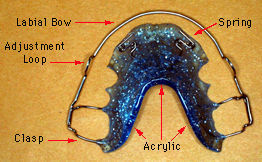

Hawley type retainer. It has acrylic and metal wires. The picture below is of an upper one. The lower one is more of a "U" shape to allow space for your tongue.

Essix clear retainer.

Fixed

Fixed (permanent) retainers are some form of connected wire that is bonded to the teeth. These come in many different forms. I use heat treated .0195 braided stainless steel, with composite bonded to each tooth. These can break, so you need to be careful with what you eat.

Healthgrades has a good review of the pros and cons of these types of retainers, that generally applies to what I do. However, there are additional "cons" to permanent retainers not listed on their site:

- The wire is bonded to your teeth. The bonding can wear out or break over time. You may, or may not be aware when this happens. If you are not aware of it, your teeth will move.

- The wire itself can break. You may or may not be aware of this, depending on where the break is, and how often you floss (to be able to feel that there is a loose section.)

- The wire needs to be heat treated to remove the memory from the wire prior to being bonded in. If not, it will move your teeth.

- There are case reports in the literature of severe root movements happening even with heat treated wires - causing periodontal damage and even tooth loss. We (as a profession) have no explanation as to what could be causing this, since theoretically there is no activity in the wire.

- These are much more difficult to clean with. Depending on your anatomy, it may or may not be possible to clean well by your gum line, and you are much more likely to collect tartar (calculus) around it.

For all of the above reasons, you need to have a dental professional check the permanent retainer at least every 6 months.

Office Technology

iTero Scanner

We use the iTero digital scanner to take "impressions" in most cases. The scanner uses a series of photos (these are not xrays) to construct a digital image of your teeth.